Pay tuition, IRS, mortgage or rent using Plastiq and earn points and miles without huge fees

A common reader question, “Can I earn miles by paying tuition with my credit cards without paying the huge fees?”

The simple answer is now, “Yes!”

The important thing is to set yourself up to be able to do it using Plastiq.

Plastiq is an online payment services that makes payments on your behalf to vendors who do not accept credit cards, or that charge exorbitant fees for credit card payments.

Bursars are hard at work finalizing Fall 2019 Semester invoices and sending notices to student accounts.

Students and parents planning to pay the upcoming balances should quickly organize to maximize valuable points and miles for making those payments.

Follow these steps

- Sign up for a free Plastiq account

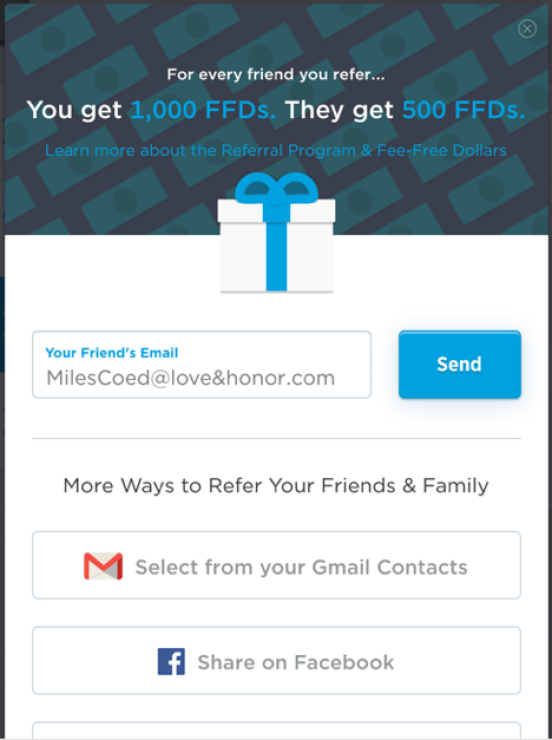

- We actually both win here.

- As a sign-up bonus, you’ll receive $500 in free payments after your first $500 in payments. That’s effectively, your first $1,000 @1.25% or $12.50 in fees.

- I’ll also receive $500 in free payments at no cost to you.

- Attach a credit or debit card to your Plastiq account.

- Create a Recipient (your school bursar’s office.)

- Tip: Be sure to use the precise recipient name, address and student account ID to ensure payment arrives on-time and posts to your student’s account.

- Watch your email inbox for targeted promotions.

Really Important!

The standard Plastiq payment rate is 2.5% This significantly, if not entirely, reduces the value of the points and miles you’d earn from using points earning credit cards.

That’s why you’re watching for at least one of the frequent promotions that Plastiq runs. I’ve been lucky enough in the past to be targeted for a 0% promotion. That was a no brainer.

How high should you be willing to go? That’s an individual choice, depending on how many miles you’re earning and what you’re applying them toward.

See bottom of post on benefit of using a new credit card to maximize miles.

Recent Plastiq promotions:

- September 2018 promotion offered 0% fees for any credit/debit card loaded to MasterPass digital wallet

- March 2019: (Business accounts only): $10,000 in payments for 0% fees after making $10,000 of payments at 2.5% fee)

- May 2019: 1% fee (reduced from 2.5%) for 3 payments up to $2,000 each

- June 2019: 1.5% fee for 3 payments up to $10,000 each

- July 2019: 1.5% fee for 3 payments up to $10,000 each

- When targeted for a promotion, make a payment(s).

- Important!

- Be sure to note the promotion’s specific terms and conditions (E.g., promo effective dates, $ maximums, which types of cards (Visa, MasterCard, AMEX are permitted)

- Allow additional days (up to 1 additional week) to ensure payment arrives on time to avoid late payment penalties

- Monitor email inbox notifications from bursar’s office that payment(s) have cleared

- Refer your friends. This gives both referrer and referred parties discounted fees on future payments up to $1,000 toward the next tuition payment.

- Pro Tip: If your school offers a low-cost extended payment plan, select this option to increase your odds of Plastiq targeting you for an offer in time to make payments for Fall 2019.

- Our family was able to make Fall 2018 payments in September by enrolling in an extended plan through Miami. We earned 95,000 Chase Ultimate Rewards.

- Advanced Tip: Using Plastiq is a phenomenal technique to reach minimum spend thresholds on new credit cards in order to unlock the sign-on bonuses.

- Caution: Applying for new credit cards without a comprehensive strategy may be detrimental to your credit score and personal finances. It can even compromise your points and miles travel goals.

More help

- For more expert advice on earning the best points and miles for your family’s travel aspirations, check out MilesHusband’s customized points earning services.

What say you?

How many points and miles do you think you can earn by paying tuition this Fall using this method? Any questions? Any other tips you can share? Please use the Comments section below.